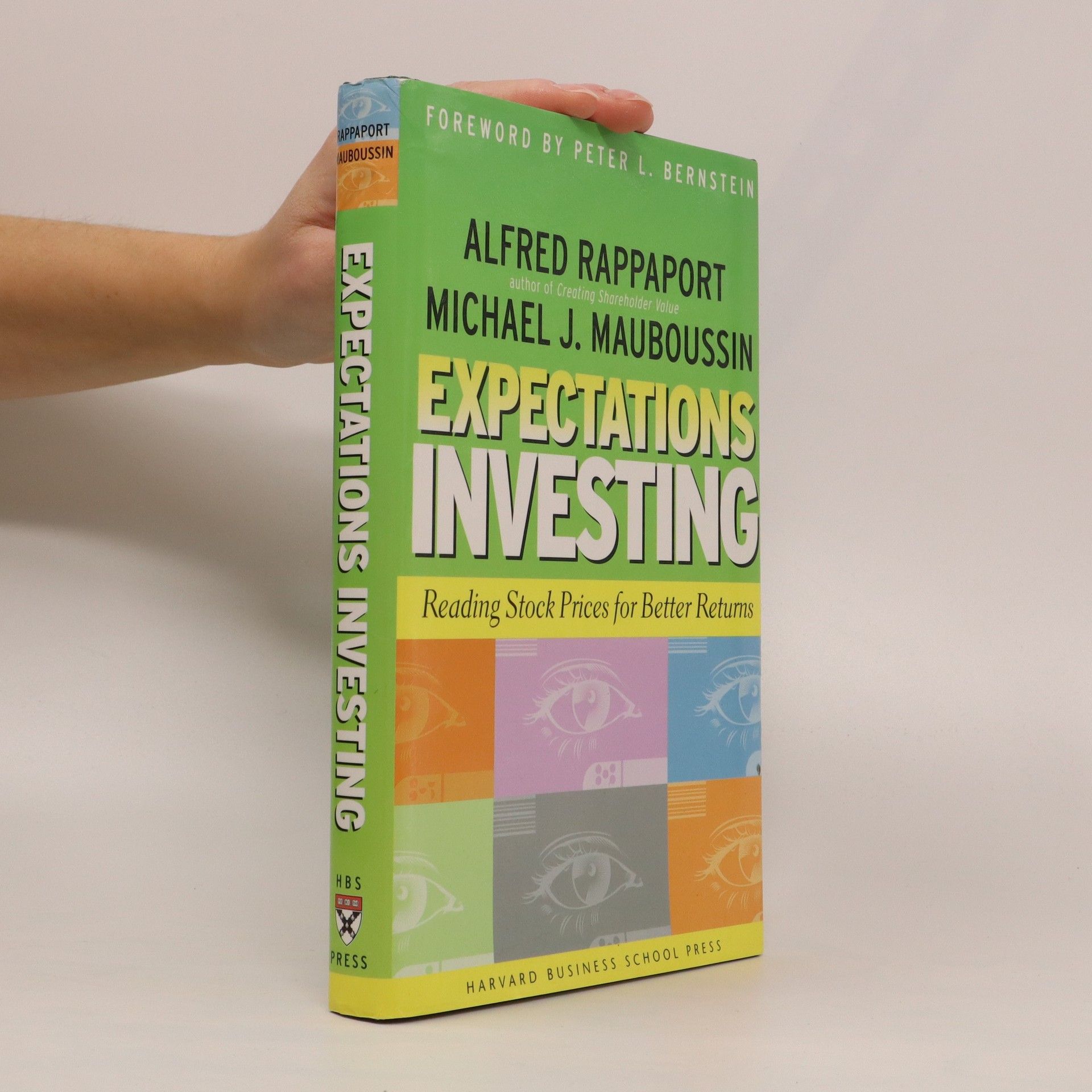

Expectations Investing

- 256 pages

- 9 hours of reading

This text aims to help investors crack the investing market. It offers a fundemental change in the way professional managers and individual investors select stock. Topics covered include: valuation of stocks; analyzing competitive strategy; the economic landscape; and mergers and acquisitions